The 2025 U.S. Rental Market: A Simple Guide for Renters

Jun 05, 2025

Written by David Dodge

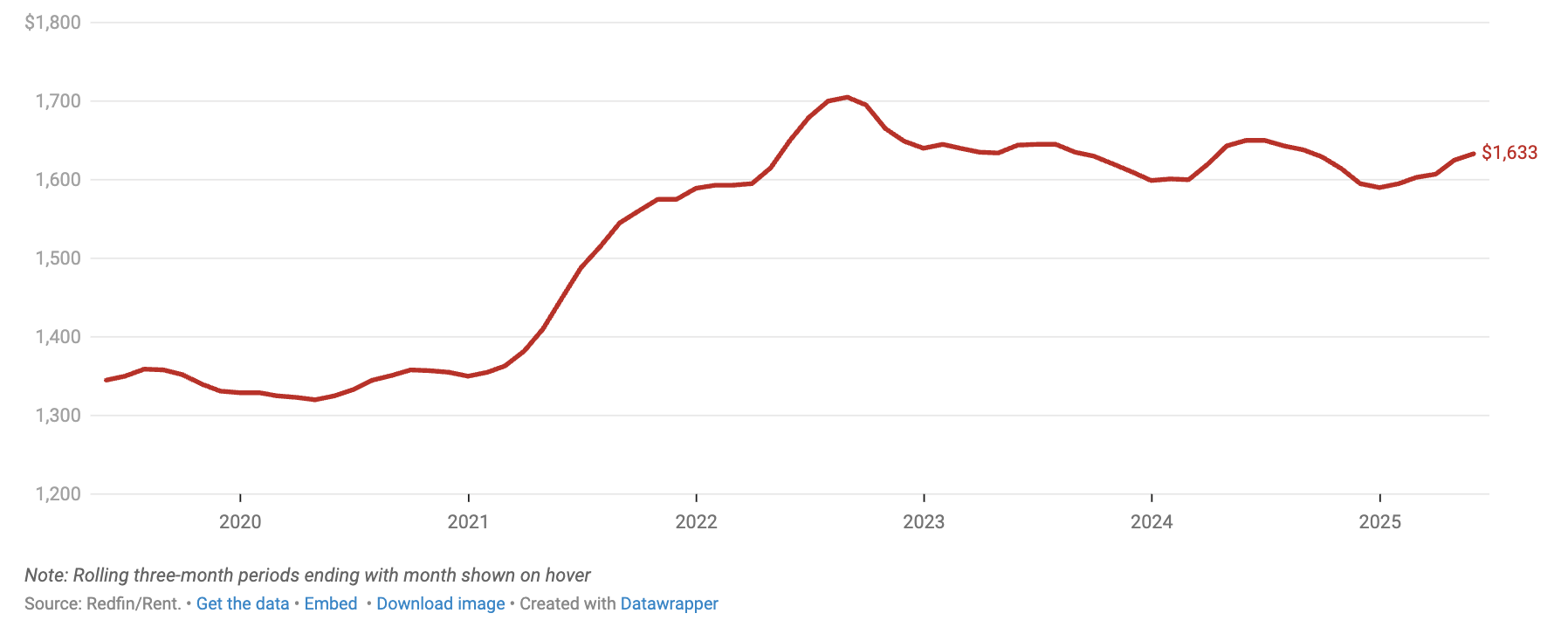

The U.S. rental market in 2025 is shifting, giving renters more leverage in many cities. According to Lily Katz’s May 2025 Redfin report, the average U.S. rent dropped 1% from last year to $1,633 in May 2025—about $72 below the August 2022 peak. Unlike the wild rent swings during the pandemic (up to 17.7% up or 4.1% down), rents have stayed steady for 15 months, moving by 1% or less each month. This stability helps renters plan their budgets better.

Why Are Rents Dropping in Some Cities?

The main reason for falling rents is a boom in apartment construction—near a 50-year high. But demand isn’t keeping up, leaving 8.2% of apartments in larger buildings empty in early 2025, the highest vacancy rate since 2021. Only half of new apartments are rented within three months, a low point historically. This oversupply lets renters negotiate deals like free rent or waived fees as landlords work to fill units.

In 28 of the 44 major U.S. cities studied, rents fell in May 2025—the most since September 2023. Austin, TX, saw the biggest drop, with rents down 8.8% to $1,385, the lowest since February 2021. Other cities like Minneapolis (-6.3%), Columbus, OH (-3.5%), and Nashville (-3.4%) also saw declines. These areas are building lots of new apartments—Austin approved 64.5 units per 10,000 people last year, more than any other major city.

Asking Rents Hover Below Their Record High (Median U.S. asking rent)

Where Are Rents Going Up?

Some cities are seeing rents climb. Cincinnati had the biggest jump, up 7.4% to a record $1,460 in May 2025. Other cities like Chicago ($1,781, up 1.9%), Memphis ($1,274, up 1.9%), and Washington, D.C. ($2,104, up 2.4%) hit all-time highs. These places tend to build fewer apartments than the national average, which may push rents up. Tampa, FL, and St. Louis also saw increases, up 4.2% and 4%, respectively.

How Rents Differ by Apartment Size

Rents are dropping at different rates depending on apartment size. Two-bedroom apartments fell the most, down 1.8% to $1,704. Smaller units (0-1 bedrooms) dropped 0.7% to $1,492, while larger units (3+ bedrooms) barely dipped, down 0.2% to $2,009. This means two-bedroom renters might find the best deals.

Renting vs. Buying in 2025

Buying a home is tough right now. The National Association of Realtors reports the average U.S. home price hit $412,300 in early 2025, up 4.8% from last year, with mortgage rates around 7%. To afford a home, you’d need to earn about $50,000 more per year than to rent. In places like Boise, ID, renters are finding nicer apartments than the homes they could buy for the same cost. Some sellers are also pricing homes too high, pushing more people to rent.

Conclusion

The 2025 rental market offers opportunities for renters, especially in cities like Austin and Columbus, where oversupply is driving rents down. But in places like Cincinnati and D.C., rents are hitting new highs, so budgeting is key. As new apartment construction slows, rents could rise again, so now’s a good time to negotiate a lease or lock in a deal. Keep an eye on your local market to make smart housing choices.

Source: Insights adapted from Lily Katz’s May 2025 Redfin rental market analysis, covering median asking rents for apartments in buildings with five or more units across 44 major U.S. metro areas.