5 Steps to Prepare Now for Buying a Home in 2026

Dec 30, 2025

Written by David Dodge

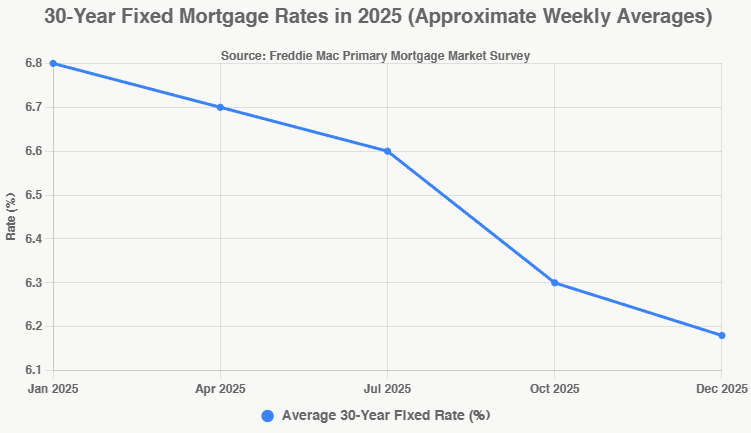

It's the end of December 2025, and if you're dreaming of owning your first home in 2026, this is the perfect moment to start getting ready. The housing market has been tough for beginners in recent years—high prices, limited options, and mortgage rates that felt stuck in the mid-to-high 6% range for much of 2025. But things are shifting in a more buyer-friendly direction.

As of late December 2025, the average 30-year fixed mortgage rate sits at 6.18%, down noticeably from peaks earlier in the year and from 6.85% a year ago. Inventory levels are higher than they've been in recent years, with active listings up significantly compared to 2024 in many markets. And while the spring buying season always brings more competition—historically, home prices can be up to 16% higher in peak summer months versus winter—starting your preparation now means you'll be ahead of the rush when listings flood the market in March and April.

The end-of-year slowdown is ideal for financial groundwork: rates are relatively stable, sellers are often more motivated, and you have time to build a strong position without the frenzy. Experts forecast modest improvements in 2026, with rates potentially dipping into the low-6% range and inventory continuing to grow, but competition could heat up as more buyers re-enter the market. By taking action today, you'll be ready to pounce on the right home with a solid offer.

Here are the five essential steps every beginner should prioritize right now.

Step 1: Get Pre-Approved for a Mortgage

One of the biggest regrets first-time buyers have is house hunting without knowing their real budget—and ending up heartbroken over homes they can't afford. Getting pre-approved fixes that.

Pre-approval involves a lender reviewing your finances and issuing a letter stating how much they're willing to lend you. It's not just about your budget; sellers take pre-approved buyers seriously, especially in competitive situations. In multiple-offer scenarios, a strong pre-approval can make your bid stand out.

Right now is a great time to shop with lenders. With the average 30-year fixed rate at 6.18% as of December 24, 2025, conditions are stable, and some lenders are offering competitive deals to close out the year. Gather your documents—recent pay stubs, W-2s, tax returns for the last two years, bank statements, and ID—and reach out to at least three lenders (banks, credit unions, online options) to compare rates and fees.

Don't skip this because you think your credit isn't perfect or you're worried about rates rising. Pre-approval is usually a soft credit pull at first, and understanding your options now gives you months to improve if needed. Plus, if rates drop further in 2026 (many forecasts suggest low-6% averages), you can always refinance later.

Avoid the common pitfall of getting pre-qualified instead—it's less thorough and won't carry the same weight with sellers.

Step 2: Check and Improve Your Credit Score

Your credit score is one of the biggest factors in your mortgage rate and approval odds. A higher score can save you thousands over the life of the loan—for example, on a $400,000 mortgage, dropping from a 680 to a 740 score could lower your rate enough to save over $100,000 in interest.

Pull your free credit reports from AnnualCreditReport.com (you're entitled to one from each bureau weekly). Look for errors like incorrect accounts or late payments you know you made on time—dispute them immediately, as fixes can boost your score quickly.

To improve: Pay down credit card balances (aim for under 30% utilization), make all payments on time (set up autopay), and avoid new credit applications, which cause hard inquiries that ding your score temporarily.

Realistic gains: Many see 20-50 point improvements in 1-3 months with consistent effort. Target 740+ for the best rates. Starting now gives you breathing room before spring.

Step 3: Save for Down Payment and Closing Costs

The financial side of buying often surprises beginners. Beyond the down payment (typically 3-20% of the home price, depending on loan type—FHA loans allow as low as 3.5%), you'll need 2-5% more for closing costs, plus reserves for moving and emergencies.

With median existing-home prices around $409,200 in November 2025, a 5% down payment on a similar home would be about $20,000- plus closing costs of $8,000-$20,000. A larger down payment lowers your monthly payment and might help avoid private mortgage insurance (PMI).

Strategies to ramp up savings now: Automate transfers to a high-yield savings account, cut non-essentials (think subscriptions or dining out), and funnel any year-end bonus or tax refund straight to your fund. Look into first-time buyer assistance programs—many states offer grants or low-interest help.

Why prioritize this in winter? You have quiet months to build without the pressure of active shopping, and a bigger cushion makes you a stronger buyer when competition picks up.

Here's a quick look at how mortgage rates have trended recently, showing the relative stability at year-end 2025 compared to earlier highs:

This downward trend into winter underscores why acting now positions you well.

Step 4: Research Local Housing Markets

Don't buy blindly—understanding your target area prevents overpaying or regrets. Prices, trends, and inventory vary hugely by location.

Start browsing sites like Zillow, Redfin, or Realtor.com to track listings, days on market, and price changes. Attend virtual or in-person open houses to get a feel for neighborhoods, commutes, schools, and amenities.

Winter advantage: Higher inventory than recent lows (up over 16% year-over-year nationally in some metrics) and less competition mean more time to learn without bidding wars. Define your priorities: Must-haves like bedrooms or location versus nice-to-haves like a big yard.

Watch 2026 forecasts—modest price growth expected (around 1-4%), with more balance as supply rises. Local factors matter most, so focus there.

Step 5: Find a Buyer-Friendly Real Estate Agent

A great buyer's agent is your advocate—they access listings (including off-market), negotiate, and guide you through pitfalls, usually at no direct cost (paid by seller).

Start interviewing now: Ask friends for referrals, check reviews, and meet 3-5 agents specializing in first-timers with strong local knowledge. Questions: How many beginners have you helped? What's your negotiation style? Can you connect me with lenders or inspectors?

Red flags: Agents pushing dual representation or lacking enthusiasm for your budget.

Building this relationship early means personalized advice during prep and a partner ready when you are.

Final Thoughts: Make 2026 Your Homeownership Year

The window between now and spring 2026 is your secret advantage—quieter markets, stable rates around 6.18%, and time to strengthen your position before competition surges.

Recap: Get pre-approved, boost your credit, save aggressively, research thoroughly, and team up with a solid agent.

Pick one step this week—maybe pull your credit report or contact a lender—and build momentum. Homeownership feels daunting, but thousands of beginners succeed every year by preparing smartly. With the market tilting toward more balance in 2026, your efforts now could lead to keys in hand sooner than you think. You've got this!