How to Spot Winning Deals with the Cap Rate Formula

Sep 15, 2025

Written by David Dodge

For anyone venturing into real estate, whether you’re analyzing your first single-family rental or managing a growing portfolio, understanding the capitalization rate—commonly called the cap rate—is a game-changer. This straightforward metric offers a clear snapshot of a property’s potential profitability, helping you make informed decisions with confidence. In this guide, we’ll break down the cap rate formula in detail, explore its practical applications, and share tips to ensure you’re using it effectively. By the end, you’ll have a solid grasp of how to leverage cap rates to spot high-value investment opportunities and avoid costly missteps.

Understanding the Cap Rate: What It Is and Why It Matters

The cap rate, short for capitalization rate, is a fundamental tool in real estate investing. It measures the potential annual return of a rental property, expressed as a percentage, assuming you purchase it outright with cash. Think of it as a quick way to gauge how much income a property can generate relative to its cost. Investors rely on cap rates to compare properties efficiently, making it easier to decide which deals are worth pursuing and which ones to pass on.

Cap rates shine brightest when evaluating multi-family properties or large portfolios, where income streams tend to be more predictable. For single-family homes, they’re still valuable but come with a caveat: net operating income can fluctuate due to factors like tenant turnover, unexpected repairs, or market shifts. While not the sole factor in your decision, the cap rate is an excellent starting point for assessing a property’s financial performance.

Breaking Down the Cap Rate Formula

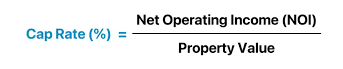

The formula for calculating a cap rate is refreshingly simple: Cap Rate = Net Operating Income (NOI) ÷ Purchase Price.

Let’s unpack the components:

- Net Operating Income (NOI): This is the annual income generated by the property after subtracting operating expenses but before accounting for mortgage payments, depreciation, or capital gains taxes. For a single-family home, NOI typically includes your gross rental income minus costs like property management fees, maintenance, insurance, and property taxes.

- Purchase Price: This is the total cost to acquire the property, including the listed price and any associated closing costs (though for simplicity, many investors use just the purchase price in the formula).

The result is a percentage that reflects the property’s annual return if purchased with cash, offering a clear way to compare investment opportunities.

A Real-World Example to Bring It to Life

Let’s walk through a practical example to make the formula crystal clear. Imagine you’re eyeing a single-family home that rents for $2,000 per month. That translates to $24,000 in annual rental income ($2,000 × 12 months). Now, factor in your annual operating expenses: property taxes, insurance, and routine maintenance, which total $6,000 per year. Subtract these expenses from the rental income to calculate the NOI: $24,000 - $6,000 = $18,000.

If the property is listed for $200,000, divide the NOI by the purchase price: $18,000 ÷ $200,000 = 0.09, or a 9% cap rate. This means the property could deliver a 9% annual return if you pay cash, excluding any financing costs.

I have a full video where you can understand it more, complete with additional scenarios and visual aids to bring the numbers to life. Watch it in the next section for a deeper dive.

Watch the Full Video for a Deeper Dive

Want to see the cap rate formula in action? I’ve created a comprehensive video that walks you through the process step-by-step, with clear examples and visuals to make the concept even easier to grasp. Whether you’re a visual learner or just want more context on how to apply cap rates to real-world deals, this video is packed with insights to boost your investing skills. Check it out below:

What Does the Cap Rate Tell You?

The cap rate is like a financial compass, guiding you through the profitability of a property. Here’s what different cap rates might indicate:

- High Cap Rates (8-10% or more): These suggest stronger cash flow potential but often come with higher risks. Properties with high cap rates might be located in less desirable neighborhoods, require significant repairs, or face challenges like higher vacancy rates. Always investigate why a cap rate is elevated before jumping in.

- Low Cap Rates (4-5%): These typically point to safer investments in high-demand or appreciating markets, such as urban centers or trendy suburbs. However, lower cap rates mean slimmer cash flow, so you’ll need to weigh whether the stability justifies the reduced returns.

- Typical Range for Single-Family Homes: Cap rates for single-family rentals generally fall between 5% and 10%, depending on factors like location, property condition, and local market dynamics.

Beyond assessing profitability, cap rates allow you to compare properties on equal footing. For example, if you’re considering two homes—one with a 7% cap rate and another with a 4% cap rate—the 7% property likely offers better cash flow. However, don’t stop at the cap rate. Dig into why the numbers differ. A higher cap rate might signal a fixer-upper or a property in a less stable area, while a lower cap rate could reflect a premium property in a hot market.

Cap rates also help you spot overpriced properties. If a home’s cap rate is significantly lower than comparable properties in the same area, it may be overvalued, signaling a need to negotiate or move on to a better deal.

How to Use Cap Rates Effectively in Your Investment Strategy

Cap rates are a powerful tool for narrowing down your options when sifting through property listings. By calculating the cap rate for each potential investment, you can quickly prioritize deals with the best financial potential. However, cap rates are just one piece of the puzzle. To make well-rounded decisions, consider these additional factors:

- Property Condition: A high cap rate might look enticing, but if the home needs extensive repairs, your actual returns could take a hit.

- Local Rental Market: Research rental demand and vacancy rates in the area to ensure your income projections are realistic.

- Appreciation Potential: In markets with strong growth, a lower cap rate might be justified if the property’s value is likely to increase over time.

Key Considerations When Using Cap Rates

- Financing Isn’t Included: Cap rates assume a cash purchase, so they don’t account for mortgage interest or loan terms. If you’re financing the property, your actual return will depend on your loan’s cost, making cap rates most useful for comparing raw property performance.

- Accurate Expense Estimates Are Critical: New investors often underestimate costs like repairs, vacancies, or property management fees, which can skew your NOI and cap rate calculations. Always err on the side of caution and use conservative estimates.

- Market Variations Matter: Cap rates differ widely by location. A 10% cap rate might be achievable in a smaller town with affordable properties, but in a high-cost city like San Francisco or New York, even a 4% cap rate could be competitive. Research local cap rate norms by consulting with investors, checking online rental listings, or consulting real estate professionals to establish a realistic benchmark for your target market.

Practical Tips for Beginners

If you’re new to real estate, cap rates might feel a bit daunting at first, but they get easier with practice. Start by running the numbers on every property you consider—it’s a great way to build confidence and sharpen your instincts. Over time, you’ll develop a sense for what constitutes a “good” cap rate in your market.

For additional support, consider joining a community like Real Estate Skool, where you can connect with experienced investors, ask questions, and access resources to refine your deal analysis. If you’re just dipping your toes into real estate, the Free Wholesale Course is an excellent starting point for learning how to find and evaluate properties. Links to both are included below to help you take the next step.

Common Pitfalls to Avoid

To get the most out of cap rates, steer clear of these common mistakes:

- Underestimating Expenses: Be thorough when calculating NOI. Include all potential costs, such as property taxes, insurance, maintenance, and a buffer for vacancies or unexpected repairs.

- Ignoring Market Context: A “good” cap rate depends on the local market. Always compare a property’s cap rate to others in the same area to ensure you’re evaluating it fairly.

- Relying Solely on Cap Rates: While cap rates are a great starting point, they don’t tell the whole story. Always pair them with a broader analysis of the property and market conditions.

Conclusion

The cap rate formula is an indispensable tool for any real estate investor, offering a clear and concise way to evaluate the profitability of single-family homes and other properties. By incorporating cap rates into your analysis, you’ll gain the confidence to identify high-potential deals and sidestep those that don’t measure up. With practice, calculating and interpreting cap rates will become second nature, helping you build a portfolio that aligns with your financial goals.

Thank you for taking the time to read this guide. For more resources to grow your real estate expertise, explore Real Estate Skool or the Free Wholesale Course—links below. These tools can accelerate your journey to becoming a savvy investor. Keep learning, stay diligent, and here’s to building wealth through smart real estate investments.

Meta Description (300 characters):

Learn the cap rate formula to evaluate rental properties with confidence. This guide breaks down how to calculate cap rates, interpret them, and avoid pitfalls, helping you spot profitable single-family homes. Watch our video and explore resources to boost your real estate investing skills!

Take Your Real Estate Game to the Next Level

Ready to master real estate investing and start making $200,000-$300,000 in your first year without using your own money or taking big risks? Our coaching and mentorship program offers hands-on guidance from me and my partner, Mike. With personalized coaching and access to our exclusive mastermind, you’ll learn proven strategies to succeed in real estate. Spots are limited, so apply today! Visit www.reiskool.com to learn more and join our program.

Keep it simple, stick to the numbers, and start crafting perfect offers today. Happy investing!

>