High-Rise Hesitation Hits Multifamily Sector

May 20, 2025

Written by David Dodge

Let’s dive deeper into the U.S. multifamily housing market’s current state, as outlined in the first quarter 2025 Multifamily Market Survey (MMS) by the National Association of Home Builders (NAHB). The term builder sentiment—a key focus here for better SEO—captures how confident (or cautious) developers are about building new multifamily properties like apartments and condominiums. The recent data shows a cooling market, and I’ll break down what’s driving this, what the numbers mean, and how it could impact renters, buyers, and the broader housing landscape. I’ll keep it conversational, human, and clear, while weaving in the “according to” citations and hyperlinking facts to the original source.

What’s Happening with Builder Sentiment?

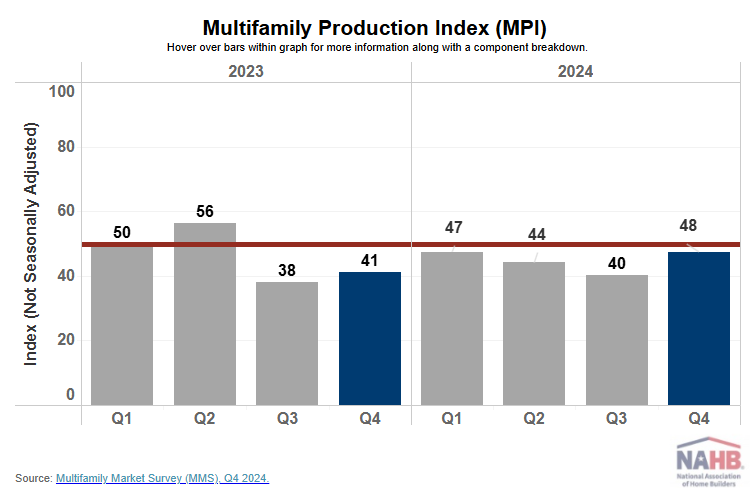

The Multifamily Production Index (MPI), which measures how optimistic developers are about starting new apartment and condo projects, dropped to 44 in Q1 2025, down three points from the same period last year, according to NAHB. An MPI below 50 means more developers think conditions are poor than good. Think of it like a mood ring for the industry: right now, it’s flashing caution. This isn’t a total collapse—some segments are holding up better than others—but it signals developers are pumping the brakes on new projects.

Why the hesitation? Developers are grappling with a triple threat:

- Rising construction costs: Materials, labor, and land aren’t getting cheaper. Over half of developers surveyed reported supplier price hikes, often tied to current or expected tariffs, per NAHB’s findings.

- Regulatory barriers: Zoning laws, permitting delays, and local regulations can make building a nightmare, especially in dense urban areas where mid/high-rise projects are common.

- Financing challenges: Higher interest rates and tighter lending conditions make it harder to fund big projects. If borrowing money costs more, developers think twice before breaking ground.

Debra Guerrero, chairman of NAHB’s Multifamily Council, summed it up: “While occupancy in existing buildings remains strong, multifamily developers are remaining cautious about starting new projects, especially mid/high-rise and condominium projects.” This caution is most evident in certain market segments, which I’ll unpack next.

Breaking Down the MPI: A Closer Look at the Segments

The MPI tracks four types of multifamily housing, and each tells a different story:

- Garden/low-rise units (think low-rise apartment complexes in suburban areas) scored 54, down slightly but still above 50, meaning developers are cautiously optimistic here, according to NAHB. These projects are often less expensive to build than high-rises, so they’re less risky in uncertain times.

- Mid/high-rise units (urban apartment towers) took a big hit, dropping eight points to 28. This low score shows developers are seriously worried about these pricier, more complex projects. Urban land costs, longer construction timelines, and regulatory hoops make these ventures riskier, especially with economic uncertainty.

- Subsidized units (affordable housing supported by government programs) held steady at 50, a neutral score. Demand for affordable housing stays strong, which likely keeps developers engaged despite challenges.

- Built-for-sale units (condominiums) slipped one point to 38. Condo markets can be volatile—buyers are sensitive to price swings, and developers might be wary of building if they think demand could soften.

This mix shows that while some corners of the market (like garden apartments and subsidized housing) are holding up, the flashier, high-stakes projects like urban towers and condos are losing steam. NAHB Chief Economist Robert Dietz noted, “The MPI of 44 supports our forecast for a modest slowdown in multifamily construction through the rest of 2025, with a possible rebound in 2026,” per the NAHB report. That “possible rebound” hinges on whether costs stabilize and economic policies, like tariffs, don’t throw more curveballs.

Occupancy Is a Bright Spot

While new construction faces headwinds, the Multifamily Occupancy Index (MOI) tells a more upbeat story. It measures how full existing apartment buildings are, and at 82 in Q1 2025 (down just one point from last year), it shows renters are still filling units, according to NAHB. An MOI above 50 means occupancy is strong, and 82 is well above that threshold. Here’s the breakdown:

- Garden/low-rise occupancy: Down two points to 82, still very healthy.

- Mid/high-rise occupancy: Up two points to 76, a surprising gain given the MPI’s pessimism about new high-rise projects.

- Subsidized unit occupancy: Down five points but still robust at 89, reflecting steady demand for affordable rentals.

This resilience suggests people still need places to live, especially in affordable and suburban complexes. High occupancy keeps landlords happy and supports rental income, but it also hints at a potential problem: if developers slow down new construction (as the MPI suggests), a tight supply could push rents higher in the future.

Why This Matters for You

So, what does this all mean for renters, buyers, or investors? Let’s connect the dots:

- Renters: Strong occupancy (MOI of 82) means apartments are in demand, especially affordable ones. But if new construction slows, as the MPI’s 44 reading suggests, fewer new units could mean higher rents down the line, especially in hot markets.

- Condo buyers: The weak MPI score for built-for-sale units (38) signals developers aren’t rushing to build condos. If you’re eyeing a new condo, you might see fewer options, and prices could stay high due to limited supply.

- Investors: High occupancy is great for existing rental properties, but the cautious MPI suggests new projects might be riskier bets in 2025. Keep an eye on suburban garden apartments, which seem more resilient.

- Broader housing market: Multifamily housing is a big piece of solving the housing shortage. A slowdown in construction could exacerbate affordability issues, especially in cities where demand outpaces supply.

The Bigger Picture: Economic and Policy Headwinds

The cautious builder sentiment isn’t happening in a vacuum. Developers are navigating a complex economic environment. Tariffs, which Dietz mentioned as a concern for over half of surveyed developers, could raise the cost of materials like lumber or steel, per NAHB. Higher interest rates make loans more expensive, squeezing project budgets. Regulatory barriers—like strict zoning or lengthy permitting processes—add time and cost, especially for urban high-rises. These factors combine to make developers think twice before starting new projects.

The MMS itself, redesigned in 2023 to align with other NAHB sentiment indices, is still building enough historical data to allow for seasonal adjustments. For now, year-over-year comparisons (like the MPI dropping from 47 to 44) give the clearest picture of trends, according to NAHB.

What’s Next for the Multifamily Market?

Looking ahead, the market’s trajectory depends on how these challenges play out. If construction costs ease or interest rates drop, developers might regain confidence, especially for garden apartments and subsidized housing, which are holding up better. A potential rebound in 2026, as Dietz suggested, could happen if economic conditions stabilize. But for now, the mood is cautious, and new projects—especially urban high-rises and condos—are on the back burner.

For anyone watching the housing market, this is a moment to pay attention. Strong occupancy shows demand isn’t going away, but a slowdown in new construction could tighten supply and drive up costs. Whether you’re renting, buying, or investing, staying informed about builder sentiment and market trends will help you navigate what’s coming.