Renting vs. Buying a Home in 2026: Beginner’s Guide

Jan 01, 2026

Written by David Dodge

If you're staring at skyrocketing rent notices or dreaming of your own backyard but cringing at mortgage rates, you're not alone. As we head into 2026, the age-old question of whether to rent or buy feels more pressing than ever for many Americans—especially first-timers navigating a market that's finally showing signs of cooling after years of frenzy.

The US housing landscape has been through the wringer: pandemic-fueled surges, record-low rates giving way to highs not seen in decades, and now a gradual thaw. Home prices are expected to rise modestly by about 1-2% nationally in 2026 .

This guide breaks it down for beginners: no jargon, just straightforward insights to help you decide based on your finances, lifestyle, and where you live. Neither renting nor buying is a slam-dunk win—it's about what fits your life right now.

Current State of the US Housing Market in 2026

After a bumpy few years, the housing market in 2026 is settling into something more balanced. Inventory is improving, with more homes hitting the market as some locked-in owners finally list .

Home prices aren't crashing, but growth is tame. Forecasts point to 1-2% national increases .

Mortgage rates are easing a touch from 2025 levels. Experts peg averages around 6.3% for the 30-year fixed . No, we're not back to sub-3% pandemic lows, but it's enough to boost affordability for those ready to jump in.

On the rental side, the market's been a renter's friend lately with flat or declining prices in many areas thanks to a boom in new apartments. But that supply wave is cresting—construction is slowing sharply, and rents could see modest bumps .

Regionally, it's a mixed bag: Northeast markets could see stronger appreciation due to tight supply, while parts of Florida and Texas cool with more homes available. Overall, 2026 feels like a “reset” year—more choices, less frenzy.

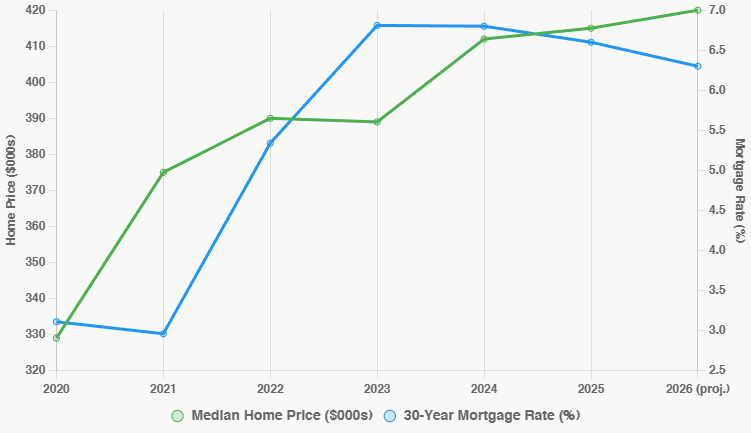

To get a clear sense of how far we've come, here’s a table showing annual median existing-home prices and average 30-year mortgage rates from 2020 through projected 2026 (historical data from NAR and Freddie Mac; 2025 approximate based on recent reports; 2026 projected from Zillow, Redfin, and Fannie Mae):

| Year | Median Existing-Home Price (Approx.) | Avg. 30-Year Mortgage Rate |

|---|---|---|

| 2020 | $329,000 | 3.11% |

| 2021 | $375,000 | 2.96% |

| 2022 | $390,000 | 5.34% |

| 2023 | $389,000 | 6.81% |

| 2024 | $412,000 | 6.8% |

| 2025 | $415,000 | 6.6% |

| 2026 (proj.) | $420,000 | 6.3% |

The dramatic shift from ultra-low rates and rapid price growth to today’s more moderate environment is easier to see when plotted over time. The chart below tracks both median home prices and mortgage rates side by side, highlighting how the pandemic-era boom gave way to higher rates and slower appreciation.

The Pros and Cons of Renting

Renting often gets dismissed as “throwing money away,” but in 2026, it still holds strong appeal, particularly when life feels unpredictable. The biggest advantages include the freedom to relocate easily for a new job or lifestyle change, far lower upfront costs since there's no down payment or closing fees involved, and the peace of mind that comes with predictable monthly expenses and having a landlord handle maintenance and repairs. With rents stabilizing or softening in some markets, many people are finding short-term deals that let them build savings without being tied down.

That said, renting has real drawbacks. You're not building any equity—every payment goes to the landlord rather than your own wealth. Rent increases, even modest ones, can add up over time, and you have limited control over the property: no major renovations, and the owner could decide to sell or end the lease. For anyone planning to stay in one place for a decade or more, the total cost can easily surpass what you'd pay on a mortgage.

The Pros and Cons of Buying

Owning a home remains one of the most reliable ways Americans build long-term wealth, and in 2026, the case for buying is strengthening as the market normalizes. The core benefits are clear: each mortgage payment builds equity through principal reduction and modest appreciation, you gain stability with fixed payments on a 30-year loan, full freedom to customize your space, potential tax deductions on mortgage interest, and a built-in hedge against rising rents.

The challenges, however, are still significant. Upfront costs remain steep—expect 3-20% down plus closing fees—and ongoing responsibilities like repairs, property taxes, insurance, and possible HOA dues fall entirely on you. With rates around 6.3%, monthly payments are higher than what earlier buyers locked in, and there's always the risk of short-term price dips in areas with excess inventory. For those staying five years or longer, though, the math increasingly favors ownership.

Financial Comparison: Running the Numbers

The only way to cut through the noise is to run your own numbers. Online rent-vs-buy calculators let you input local prices, rates, and assumptions to see the real picture. In many markets right now, the monthly cost of owning versus renting is surprisingly close, but buying starts pulling ahead once you factor in equity buildup and tax benefits. The typical break-even point—when owning becomes cheaper overall—falls somewhere between three and seven years.

Take a realistic example: a $420,000 home with 10% down at 6.3% might carry a total monthly cost (principal, interest, taxes, insurance) around $2,750. A comparable rental could run $2,500–$2,700. At first glance, renting looks cheaper, but after a few years, the equity you've gained and potential appreciation tip the scales. Don't forget hidden costs either—homeowners budget roughly 1% of the home's value annually for maintenance, while renters face the uncertainty of future rent hikes.

Personal and Lifestyle Factors to Consider

Money tells only part of the story. How long you plan to stay in one place is the single biggest lifestyle question: shorter than five years usually favors renting, while longer stays make buying more compelling. Think about job stability and mobility needs, family plans that might require more space or flexibility, and your overall tolerance for risk—whether that's handling unexpected repairs or depending on a landlord's decisions. Market timing can feel tempting, but waiting for the “perfect” moment often means missing out on years of equity growth.

Regional Differences and Hotspots

Where you live changes everything. In the Northeast, tight inventory continues to drive stronger price growth, while many Sun Belt markets now offer more choices and potential buyer leverage thanks to higher inventory levels. Tools like Zillow, Redfin, or Realtor.com make it easy to dig into your specific area's trends.

Steps to Decide and Prepare

Start by taking stock of your finances—credit score, savings for a down payment or emergency fund, and debt-to-income ratio. If buying interests you, get pre-approved for a mortgage to understand your real budget. Run scenarios on multiple calculators, consult a realtor or financial advisor for local insight, and think ahead: what happens if rates drop further, or if rents climb faster than expected?

Conclusion

As 2026 unfolds, the housing market is finally giving Americans a breather after years of extremes. Renting still offers genuine flexibility and lower barriers to entry, making it the smarter short-term move for anyone whose life feels in flux—whether that's chasing career opportunities, testing out a new city, or simply building up savings without the weight of homeownership responsibilities. Buying, on the other hand, positions you to capture long-term wealth in a market where modest appreciation and stabilizing rates are bringing affordability back within reach for prepared buyers.

The truth is there's no universal “winner” here. For some, continuing to rent while investing elsewhere will feel liberating and financially sound. For others, locking in a home now—before another potential wave of demand pushes prices higher—will prove to be one of the best decisions they ever make. What matters most is resisting the pressure of national headlines and focusing instead on your own timeline, budget, and goals.

Run the numbers for your specific situation, talk to people who know your local market, and trust the math over emotion. Whichever path you choose—renting with intention or buying when you're truly ready—you'll be taking a thoughtful step toward greater financial stability and peace of mind. Housing decisions shape years of your life, so permit yourself to choose what actually fits right now. The market will keep evolving, but an informed choice today puts you in control no matter what comes next.