How 2026 Mortgage Rate Trends Affect Real Estate Strategies

Feb 02, 2026

Written by David Dodge

Understanding mortgage rates is critical for anyone involved in the U.S. real estate market — buyers, sellers, and agents alike. In early 2026, mortgage rates aren’t just a number; they’re an economic signal that shapes affordability, consumer confidence, transactional activity, and long-term planning.

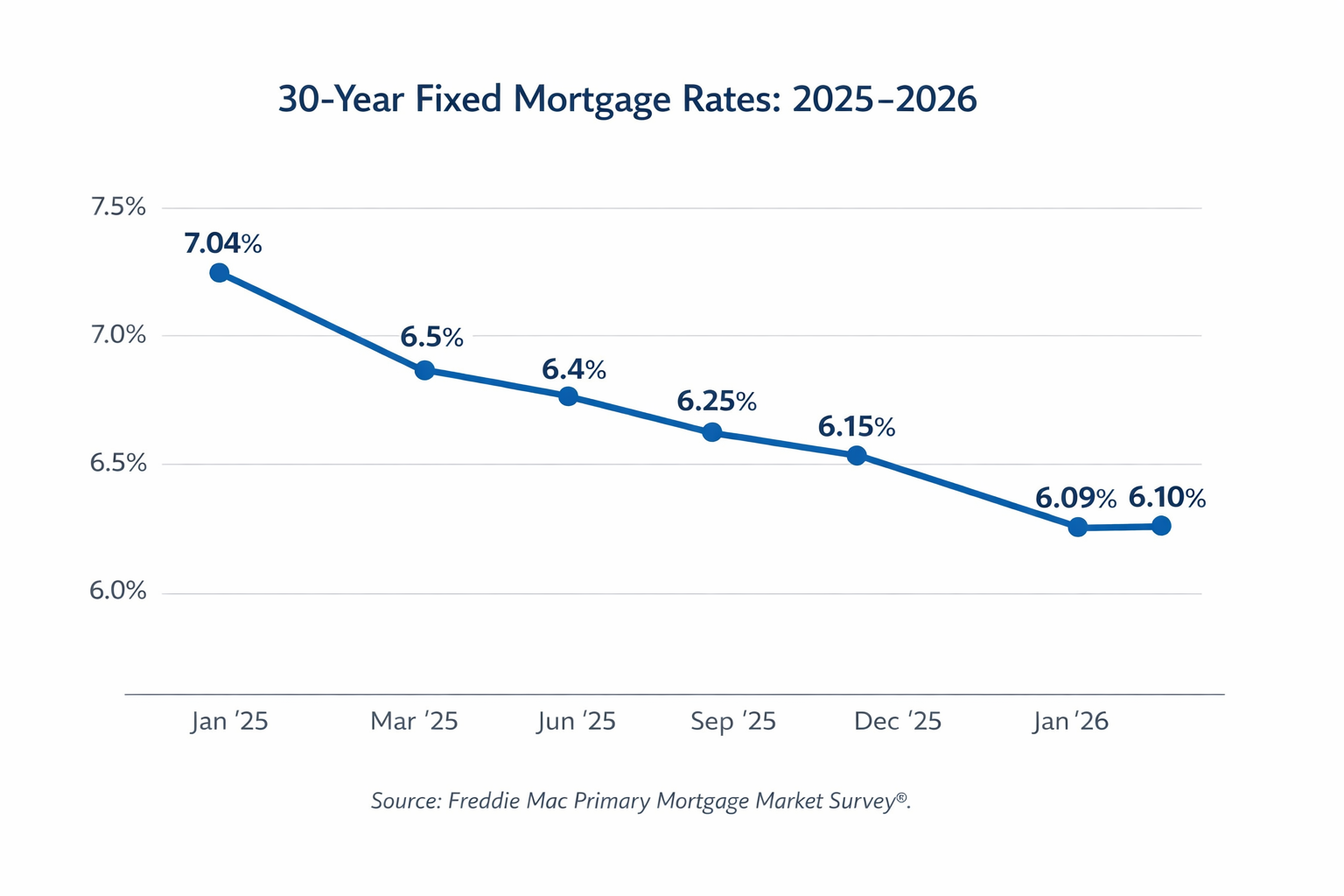

As of late January 2026, the average 30-year fixed mortgage rate is about 6.10%, hovering near its lowest level in more than three years, according to Freddie Mac data.

This relative retreat from the elevated rate environment of recent years has nuanced implications — and understanding them will help you build stronger strategies whether you’re coaching clients, advising decision-makers, or planning transactions yourself.

1. Understanding the Data: Mortgage Rates and the U.S. Market

Right now, the most widely used benchmark for home loans — the 30-year fixed mortgage rate — is averaging around 6.10%, slightly higher than the prior week but still historically subdued (Freddie Mac data).

Here’s a simple data snapshot to visualize this trend:

What the graph shows:

-

Mortgage rates have eased significantly from around 7.04% in early 2025 to the low-6% range in early 2026.

-

This shift — even if modest — conveys a meaningful improvement in borrowing conditions for many buyers.

-

Rates remain well above the ultra-low era of the early 2020s, but are now more favorable than the discouraging highs of 2025.

Why This Matters for Homebuyers in 2026

Mortgage rates directly affect what buyers can afford — influencing demand, negotiation dynamics, and client behavior.

A. Affordability and Buying Power

When mortgage rates decrease, even slightly:

-

Monthly payments drop for the same loan amount.

-

Buyers qualify for larger mortgages at the same monthly budget.

-

The pool of affordable homes expands.

For example, a homebuyer who was previously qualified at a 7.0% rate may see notable monthly savings when that rate dips into the low-6% range — making previously borderline homes suddenly attainable. This is why even a modest drop matters.

B. Buyer Psychology and Market Timing

Rates near multi-year lows create psychological optimism among buyers:

-

Some buyers who delayed purchases in 2023–2025 are re-entering the market.

-

Expectations of future rate softening can influence timing — but buyers should also avoid waiting indefinitely since prices and rates are both fluid.

Educated clients understand the dynamics: today’s rates are generally more favorable than most of the prior two years, but they are not guaranteed to fall sharply in the short term.

Impacts on Sellers: Pricing, Timing, and Buyer Expectations

A. Increased Seller Confidence as Rates Ease

Many homeowners sat on the sidelines for years because:

-

Their existing mortgage rates were lower than what they could secure for a new purchase.

-

Moving would mean giving up a low rate for a higher one.

Now, as the gap between older loans and current rates shrinks, some of that “lock-in effect” begins to soften — meaning more sellers could be willing to list homes, especially if they have equity built up or life circumstances (e.g., relocation, upsizing) driving their decisions.

B. Strategic Pricing in a Nuanced Market

Sellers must price homes with buyer affordability in mind:

-

While rates have improved from recent highs, many buyers are still constrained by cost pressures.

-

Competitive pricing aligned with financing realities helps attract offers and reduces negotiation snags.

-

Highlighting features that reduce total cost of ownership (e.g., energy efficiency) can differentiate listings.

In today’s market, pricing isn’t just about comps and square footage — it’s about financing feasibility for motivated buyers.

Broader Market Forces at Play in 2026

A. The “Great Housing Reset”

Industry forecasts describe 2026 as a year of gradual adjustment rather than dramatic rebounds — sometimes dubbed the “Great Housing Reset.” This narrative frames the market as slowly recovering from years of affordability stress and inventory shortages. (mpamag.com)

Under this scenario:

-

Affordability improves slowly as incomes rise faster than prices.

-

Sales volumes edge upward but don’t spike dramatically.

-

Mortgage rates remain elevated by historical standards, but persistently near recent lows.

This is not a rapid rebound; it’s a steady normalization. Some markets will heat faster than others, but the overall trend supports cautious optimism — especially for agents who can coach clients through the nuances.

B. The Role of Home Inventory

Limited inventory has been a barrier to affordability. Even with rates around 6%, the shortage of available homes dictates pricing and negotiation leverage.

As inventory improves — even modestly — buyers have more choice, and sellers must align expectations accordingly. Mortgage rates interact with inventory dynamics to shape transaction activity levels.

Strategies for Real Estate Agents in 2026

Mortgage rate trends aren’t just data points — they’re conversation drivers that can make or break deals.

- Translate the Data for Clients

- Clients don’t always understand rate numbers — but they do understand dollars and monthly payments.

- Your job as an agent is to translate:

- “Rates near three-year lows”

- into what that means for monthly payment differences, loan size possibilities, and offer competitiveness.

- Coach Clients on Financing Options

- Mortgage rate movements open doors for:

- Buyers are considering locking in rates now to avoid potential upward shifts.

- Sellers who may benefit from buyer incentives like rate buydowns.

- Investors are evaluating yield and cap rate impacts due to financing costs.

- Agents who can explain different loan scenarios (e.g., ARMs vs. fixed) build deeper trust and accelerate decision-making.

- Mortgage rate movements open doors for:

- Use Mortgage Trends to Shape Marketing

- In email newsletters, social media, and listing presentations, you can educate clients by:

- Charting current rate trends.

- Explaining how rate changes affect home equity and price negotiations.

- Providing localized examples of how rates influence specific markets.

- In email newsletters, social media, and listing presentations, you can educate clients by:

Educated consumers feel in control, and educated clients are more likely to act — often with you as their advisor.

Common Client Questions — Answered

Q: Should we wait for mortgage rates to drop further?

A: Maybe — but waiting can backfire if home prices climb simultaneously or inventory shrinks. Rates in the low-6% range are favorable compared with recent years, and timing the market perfectly is rare. Agents should weigh individual risk tolerance, financial capacity, and local market conditions.

Q: What if inventory stays tight?

A: Tight inventory often means stronger pricing power for sellers. Buyers who understand value and financing options can still win deals. Agents can coach buyers on competitive offers and strategic contingencies.

Q: Do refinancing opportunities matter right now?

A: Yes — homeowners can benefit from refinancing into lower rates, freeing up cash flow and helping buyers and sellers leverage equity.

Forecasts for the Rest of 2026

Experts forecast a cautiously optimistic picture:

-

Rates will stay elevated relative to pre-pandemic norms, but comfortably lower than recent peaks (mpamag.com)

-

Sales volumes may grow gradually.

-

Home prices are likely to rise modestly.

This confirms that real estate in 2026 is about incremental gains and strategic positioning, not dramatic swings.

Turning Mortgage Trends into Action

Mortgage rates may not be the only factor driving the 2026 housing market, but they remain one of the most influential levers shaping buyer behavior, seller decisions, and overall market strategy. What we’ve seen in the past year — a decline from highs near 7% to a stabilized low-6% range — is more than a number. It’s a signal that the market is finding a new rhythm, one where careful strategy, informed decision-making, and timely action can make all the difference.

For buyers, these rates present a unique opportunity to lock in favorable financing before rates fluctuate further or home prices continue to rise. Understanding how even a fraction of a percent affects monthly payments can empower buyers to make confident, informed decisions, whether they’re entering the market for the first time or trading up. For sellers, the easing of rates can translate into increased buyer interest and more leverage for pricing and negotiation — but only if homes are positioned correctly in the market and communicated effectively.

For real estate agents, this is a pivotal moment. Your expertise in translating these complex trends into actionable guidance is invaluable. Clients are looking for more than a transactional agent; they want a strategic partner who can navigate the nuances of mortgage rates, affordability, and market timing. By using data like the Freddie Mac mortgage rate trends, creating scenarios, and presenting clear options, you don’t just close deals — you build trust, credibility, and long-term client relationships.

Looking ahead, 2026 isn’t about dramatic swings in the market; it’s about incremental wins, informed decisions, and positioning yourself — and your clients — for success. Those who understand the interplay between rates, inventory, and buyer behavior will have a distinct advantage. The takeaway is clear: mortgage rates are more than numbers; they are the key to smarter strategy, better timing, and stronger outcomes in every transaction.

Now is the time to act, educate, and lead. Whether it’s coaching a first-time buyer on affordability, advising a seller on competitive pricing, or creating a marketing strategy that leverages current trends, your role is to turn insight into action. With rates stabilized near three-year lows, the opportunity is real — and the results will go to those who are prepared, informed, and proactive.

In short, 2026 is shaping up to reward agents and clients who see the data clearly, plan strategically, and act decisively. Use this knowledge, embrace your role as a trusted advisor, and you won’t just navigate the market — you’ll thrive in it.